Insuretech

Fintech

Healthtech

When regulatory change upends the game, it’s comply or die

Have you ever faced an immovable deadline that required reinventing your business model — and completely transforming your tech stack — all while seamlessly serving 20k+ members? Sedera did, and Altus Nova was there to lead the way.

Challenge

Re-platform medical cost sharing solution to avoid business model-busting regulatory changes

Solution

Separate member savings + enable thousands of real-time transactions to facilitate cost sharing

Results

Our 100% compliant replatform is the most secure cost-sharing solution in the industry

Client

Sedera enables medical cost sharing between members of their rapidly growing digital community. In 2020, this non-profit fintech and healthtech innovator ranked #193 on the Inc. 5000 list of the fastest-growing private companies in America, putting them in the top 4% of companies overall.

Altus Nova's discovery approach helped us align on goals, identify challenges and develop risk mitigation options, ultimately enabling us to define an effective product roadmap and execute against aggressive deadlines. We found the Altus Nova team’s management and product mindset to be extremely unusual and valuable in a software development partner."

Challenge

Sedera’s platform handles enrollment, renewal, needs review, community cost sharing, and billing for more than 20k members. To execute efficiently at scale, member funds were pooled for management by the Sedera financial team — as was consistent with the industry standard.

But in 2019, regulatory changes required organizations like Sedera to protect against acting as unlicensed money transmitters, and to create ironclad safeguards against member fund mismanagement.

This gave Sedera just 6 months to bring their business processes and legacy platform into compliance.

Discovery

Sedera’s executive team recognized Altus Nova’s meticulous yet efficient process as the way to get it right the first time, and on time. With Altus Nova’s ability to facilitate aligned action, a combined team worked to define:

- An industry bar-setting model for secure stewardship of member funds in separate, member-owned accounts with an accredited banking partner.

- Reinvented processes for member enrollment, contribution management, and member-to-member direct transfers as medical needs are approved for sharing within the Sedera community.

- The electronic integration that would enable real-time transfers through a banking partner so that Sedera could continue providing the timeliness and efficiency their members had come to expect.

To support these substantially new business requirements, much of Sedera’s legacy platform would need to be rewritten — or a new platform would need to be built — as the clock bore down on an immovable deadline.

Solution

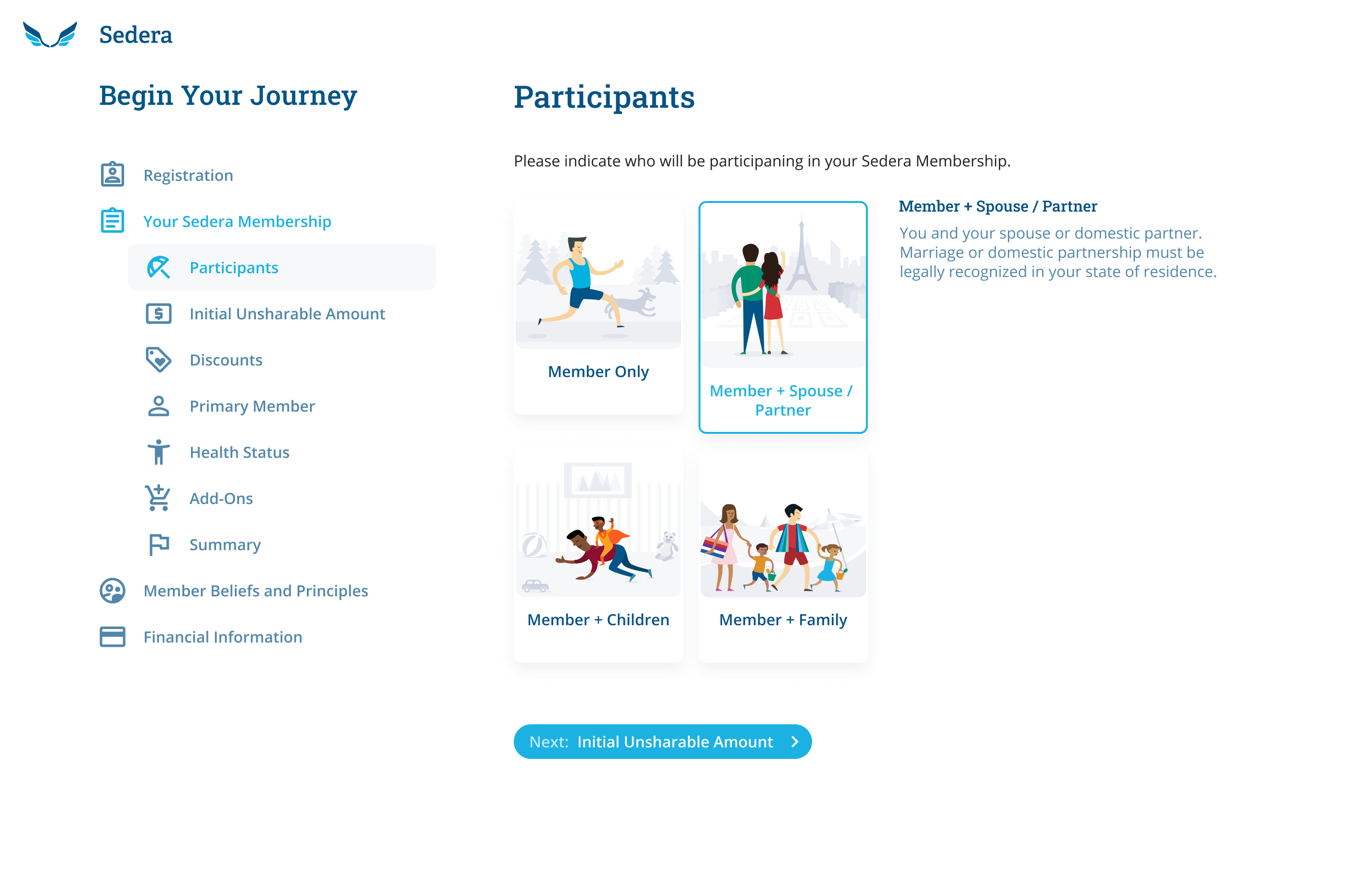

Created in Salesforce, Sedera’s legacy system was expensive to operate, difficult to resource with skilled developers, and kludgy to customize or extend. What’s more, one of the most pivotal user experiences — member enrollment — was extremely difficult for users to complete.

Rather than keep fixing the legacy system, Altus Nova proposed a new architecture. By replatforming with a highly scalable and cost-effective serverless architecture in the Microsoft Azure cloud, Sedera could:

- Achieve timely compliance and set a new industry standard for member fund management.

- Better satisfy members with an improved user experience.

- Gain the technological flexibility to innovate and compete.

Based upon Altus Nova’s clear-eyed comparison of the costs, risks, and rewards of investing in the legacy system vs. building a new platform, Sedera chose the path of innovation.

Process

Altus Nova assessed and visually mapped out every step of the enrollment and membership flow — including both Sedera and the banking partner’s business processes needed to support the user experience — so that every department and discipline involved could provide critical input.

Leveraging the full range of institutional knowledge and member feedback, Altus Nova then proposed an improved flow and associated functionality, taking into account all primary processes and solved for key edge cases.

With executive and front-line operator buy-in on a clear roadmap that aligned all parties, Altus Nova was able to push multiple feature sets forward in parallel, and dynamically incorporate business and regulatory feedback into the build.

Altus Nova diligently explored and intimately understood the dependencies between Sedera’s business needs, partner and regulatory constraints, existing technologies and the new Sedera platform. By meticulously documenting detailed feature requirements that incorporated such constraints, their engineers developed our platform correctly the first time. They not only ensured a sound Sedera product strategy, but provided fastidious product and project management enabling the numerous puzzle pieces which exist in such complex platforms to come together seamlessly. "

Method

To reduce the total cost of ownership and innovation for this rapidly growing client, we needed to ensure that skill sets required to develop, maintain, or expand the solution must be readily available and easy for Sedera to hire.

To ensure this kind of platform scalability and cost efficiency, we developed the back-end in the Microsoft Azure cloud, using serverless capabilities. We chose to create the front-end with a responsive design that would fully support both mobile and desktop experiences in React.

Using React also meant that the platform would be deployed as a Progressive Web App (PWA), which provides the capabilities of a native app without the adoption barriers — no need for users to download or install an app from Apple or Google stores.

Easy platform maintainability was ensured by partitioning the functionality using a microservices architecture. We enabled the solution to integrate with ACB and with 3rd party benefits systems by exposing REST APIs securely through the Azure API Gateway.

Finally, we integrated with the legacy system to save precious time. Not having to build non-critical parts of the new system right away maximized the engineering team’s ability to tackle critical features for launch.

Experience

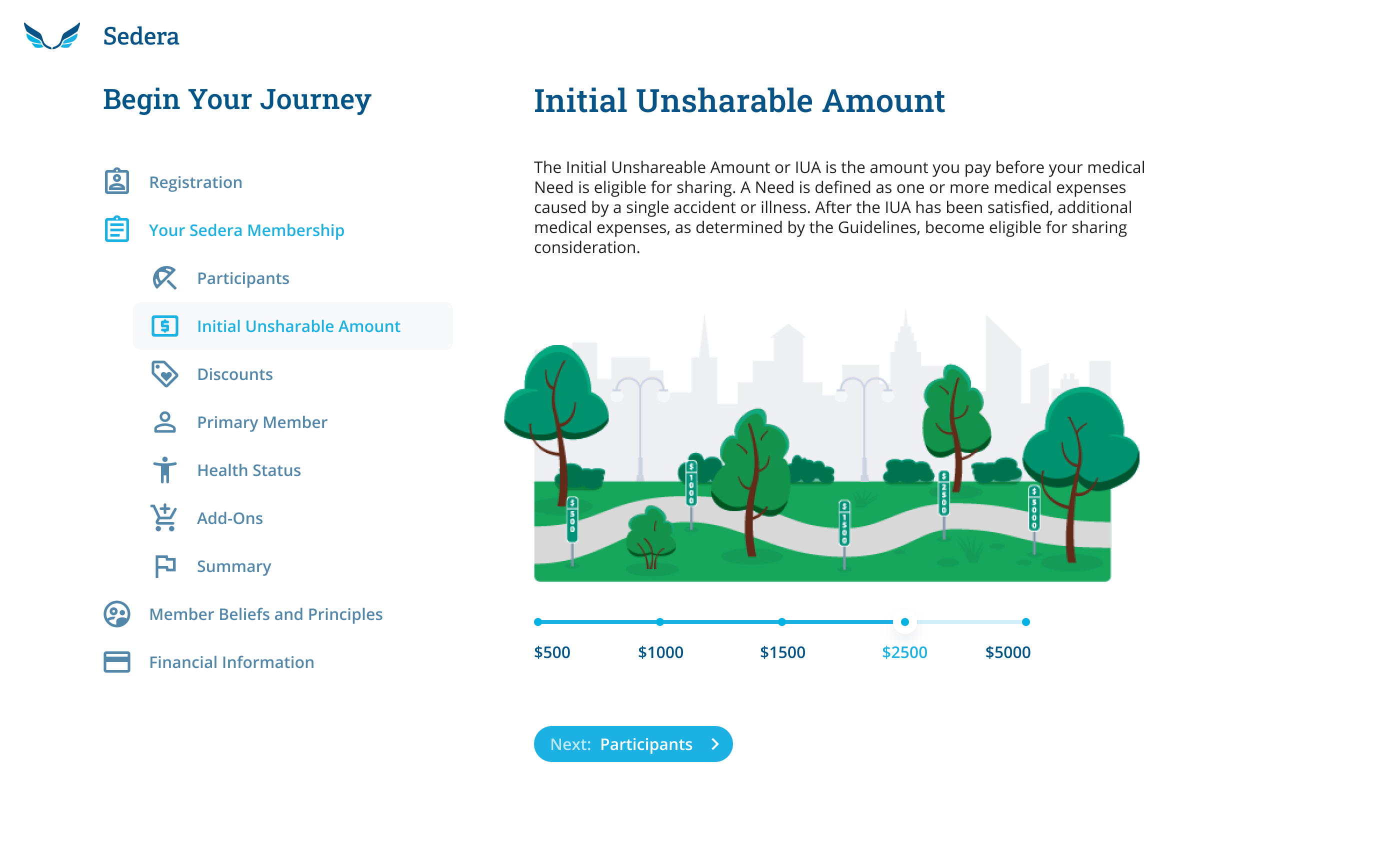

Our designers expertly interpreted new requirements to manifest a simplified way for members to navigate complex processes. The new flow allowed users to baby-step through enrollment, banking verification, and membership management with clean interfaces, clear flows, and fresh illustrations that minimized customer support calls.

To provide deep capability and customization specific to Sedera’s brand — while at the same time minimizing Sedera’s investment in establishing their own proprietary Design Language System — we published design specs in a UI Kit based on Google’s Material Design.

By publishing design specifications in Figma, both Altus Nova’s and Sedera’s designers and developers were able to collaborate on every nuance of the design (fonts, sizes, colors, patterns), leaving nothing to interpretation. This enabled a pixel-perfect implementation of the live solution as compared to the approved designs.

Results

The new platform designed and developed by Altus Nova enabled secure, peer-to-peer cost sharing with separate, member-owned bank accounts while maintaining the real-time transactional efficiency of a single-payer.

Altus Nova led Sedera to a new, compliant platform with an improved user experience that also provides newfound flexibility to win new members and meet future business challenges — including regulatory change.

Altus Nova's exceptional team and unmatched expertise enabled Sedera to define an effective product roadmap and execute against aggressive deadlines. They are truly a one-of-a-kind, refreshing, and valuable software development partner."

Technologies

Design

- Figma

- DLS using Material Design foundation

Front End

- React 16 (PWA, SSR)

- Next

- Material UI

- Contentful

- TypeScript

- React Redux + Jotai

- Formik

- ESLint

- Custom ESLint rules

- Commitment

- Stylelint

- documentation.js

- Lodash

- Jest

- Husky

Back End

- Microservices based serverless Azure solution using App Service

- Azure Active Directory

- Azure Active Directory B2C

- Azure Compute Functions

- Azure SQL DB

- Contentful (headless CMS)

- Azure Event Grid

- PDF Filler (invoice & statement generation)

- Webhooks

- Azure Data Factory with messaging and notifications using SignalR

- SendGrid

- Twilio

Integrations

- 3rd Party banking system hosted in Amazon Web Services

- Numerous 3rd party Health Benefits Management Systems (for preloading enrollment data)

- Plaid (for banking authentication)

- WorldPay (for credit & debit card transactions)

- Dwolla (for employer ACH payment processing)

- Salesforce.com (for employer history and needs coordination/approval)

Monitoring + Alerting, Live Ops

- Azure Application Insights

- Sumo Logic

- PaperDuty

Test & Automations

- TestRail

- Selenium

- Azure Test Plans

Deployment

Azure Pipelines

![[object Object]](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Ffiodz0wg%2Fproduction%2F31d51604cbd808e663e4f6d6c57966b5cd96bb12-792x653.jpg%3Ffit%3Dmax%26auto%3Dformat&w=3840&q=75)